Assess and evaluate diverse concepts to elevate your product from a theoretical notion to a successful reality.

Product design and development is an evolving process. Testing, enabling, and disabling features, refocusing, and refinements during the process indicate that this journey may involve a mix of direct and indirect approaches to facilitate desired outcomes.

Nonetheless, businesses need specific parameters to serve as checks and help channel efforts in the right direction that makes business sense. This ensures financial return for the investments.

In this post, we take a comprehensive look at product testing and explore how comparing critical metrics such as purchase objective, features, and value can help us to determine concepts that customers find most relevant to their needs.

What is product experience (PX)?

In the US alone, nearly 85% of new products fail, partly due to a lack of testing before investing. Instead of engaging with customers, companies often rely on lagging transactional data while making product decisions in a vacuum, leading to unsuccessful products.

Here’s where understanding Product Experience (PX) can change the dynamics. Product Experience may be summarized as your customer’s journey with your product from start to end. It determines your customers’ perceptions of product design, functionalities, and features, influencing their purchase and usage behavior.

Where Customer Experience (CX) is linked to the touchpoints in a customer-business relationship, PX focuses exclusively on how your product or service delivers. This makes PX management a critical function within every company.

Within the IT industry, product experience (PX) refers to the segment of your customer journey that takes place within the application.

Software products must educate, engage, and adapt to users’ needs, heightening product experience management’s value.

According to growth, sales, and marketing insights published by McKinsey & Company, design-driven companies have outperformed the S&P 500 significantly.

For example, the unique visitors to Walmart’s website increased by 200 percent when it revamped its e-commerce experience. Similarly, when Bank of America’s online-banking traffic rose by 45 percent when it implemented a user-centered redesign of its account registration process.

Organizations are increasingly adopting CRM, point-of-purchase, and the Internet of Things to source operational data. Today, leading product managers are focusing on understanding the product lifecycles, and providing actionable recommendations to improve the product experience they deliver, thereby measurably growing revenues.

At the same time, product teams alone aren’t responsible for PX. It is the combined effort of marketing, customer support, and other customer-facing teams too.

What is product experience survey?

Implementing PX Testing facilitates regular customer feedback and helps businesses deliver successful products and services while avoiding misconceptions about user experience.

A PX survey is a set of questions addressed to your customer group to collate valuable user feedback on their user experience. PX surveys can help you establish a data-centric understanding of your customer sentiment and validate ideas and hypotheses to deliver products and services that match their needs and expectations.

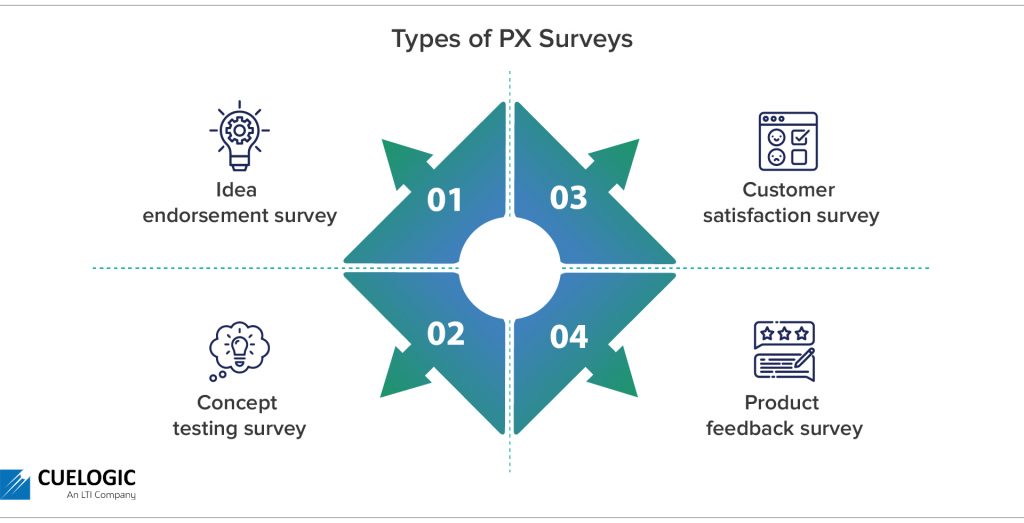

Types of PX surveys

Here are some popular surveys you can choose from to support your product development and curate a list of the right product survey questions:

Idea endorsement survey

While every product feature originates from a great idea, an endorsement survey can help you understand if your customers will use your solution and provide feedback about the acceptance of your idea.

Concept testing survey

If you’ve identified a potential problem that you want to address, a concept testing survey can help you understand customer responses to your possible solution before investing resources into developing them. A concept testing survey is one of the easiest and most effective ways to gauge customer feedback.

It’s ideal for understanding how your users feel about your concept and the solutions that are of the most significant value. This can help you identify solid ideas and channel your efforts in the proper direction.

Customer satisfaction survey

Satisfaction surveys leverage standard metrics like Customer Satisfaction Score (CSAT) and Net Promoter Score (NPS, also known as Net Promoter System and developed by Fred Reichheld) to measure the success of your product. They help you understand customer satisfaction levels and service or product feedback by asking the right satisfaction survey questions.

Product feedback survey

Product survey can provide great user experiences by providing a deeper understanding of your customers’ issues, needs, expectations, and opinions. It helps gain deeper insights into the features of your product that are performing well and those which need more improvements to get you ahead of the competition.

PX Testing approaches broadly include In-Home Tests, where research is conducted as consumers use the product in their homes, or Central Locations Tests, where consumers participate in the survey within controlled environments.

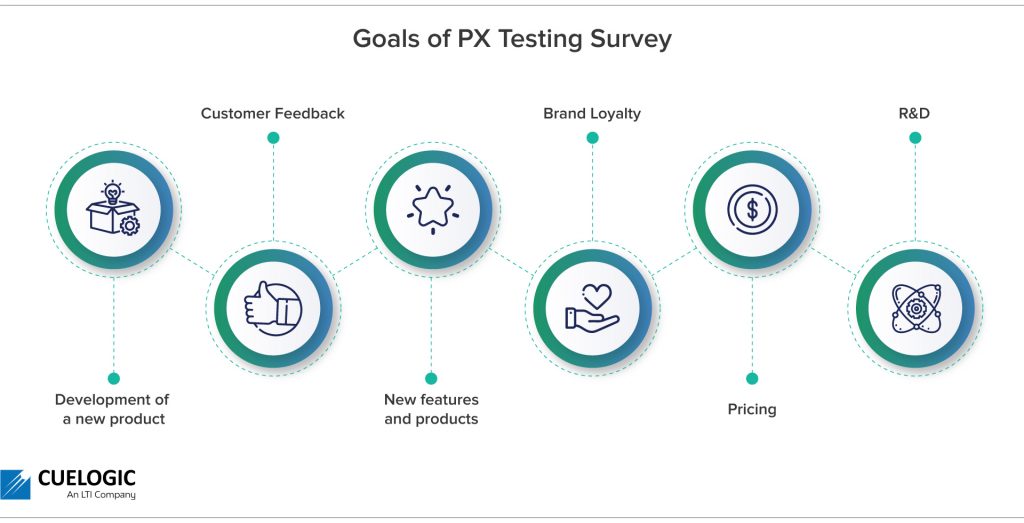

Goals of PX testing survey

Depending on your needs – whether you’re entering a product, service, or technology market, PX Testing helps you minimize your risks and protect your investment. Businesses typically implement PX Testing to help achieve the following goals:

Development of a new product

If you are developing a new product, it’s a safe idea to test the product before commencing mass production to understand the initial reactions to your product among your target users. Moreover, businesses often incur heavy losses in recalling new products because of problems recognized only once the product is sold.

Businesses that regularly test users’ experiences throughout the product development stage can create more successful products that demonstrate proof of concept and ensure the final product matches customer requirements.

Poor/negative customer feedback

Businesses committed to customer satisfaction implement PX Testing surveys to identify negative experiences and feedback reported by customers while using the products. Addressing these experiences even in a growing market helps businesses validate/invalidate the critical responses and avoid future risks.

New features and products

If you’re planning to add a feature to your already successful product, PX Testing will enable you to understand your customer’s reactions to this new feature, which you would need to address suitably. Thus, PX Testing at the onset can also help you prevent costly errors or oversights as users try out the product and provide critical feedback.

One of the main reasons products fail is because users are not fully aware of the value and potential of a product to solve a problem. PX Testing allows consumers to understand your product features and capabilities better.

Brand loyalty

Delivering products that are relevant among different user groups influences repeat purchase decisions and goes on to build brand loyalty. Moreover, testing the product experience amongst your diverse consumers will also help you gain insights into how different customers engage with it.

Pricing

Price expectations, including incentives, cross-product offers, and warranties, influence product value perceptions among buyers. PX Testing the pricing and incentives help businesses to manage price expectations, especially for new product adoptions.

Research and development

Product development or enhancement can be a costly affair. Therefore, incorporating features that customers don’t need can affect your profitability. Thus, PX Testing before a full-scale launch will help ensure cost-efficient R&D spending.

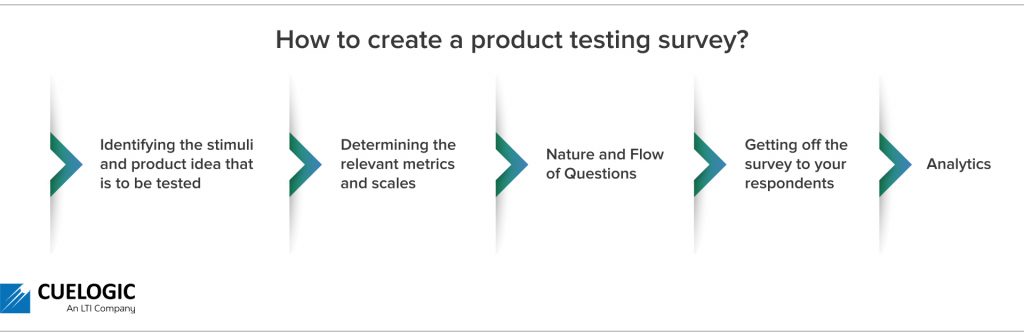

How to create a product testing survey?

If you decide to go ahead, this simple guide with the best practices will help you develop customer-friendly and actionable customer survey templates. The main stages are:

1. Identifying the stimuli and product idea that is to be tested

There’s no limit to the range of product concepts you can test. Nonetheless, it’s best to choose stimuli that you’re already familiar with based on an informal, preliminary survey among colleagues and friends. Selecting products in a similar development stage will improve your results’ accuracy.

Present the attributes in a simple, straightforward way, which is easy to compare. For example, testing a popular feature against a new feature in the very early stages of development will not give you an accurate result.

Secondly, identify the methodology that best fits your needs. Limiting the number of stimuli makes the customer survey more manageable. The maximum number of stimuli to include in the test depends on the survey tool and methodologies. This includes:

Monadic (Single concept evaluation)

Respondents fully evaluate a single concept. Once you’ve collated sufficient feedback, you can pick a winning concept by aggregating the respondents’ feedback.

This survey gives you a clear picture of individual features and the shortcomings that may affect its success in the future. Typically being a short questionnaire, it enhances the survey’s data quality and completion rate. However, it can get expensive. Since you’ll be targeting just one stimulus per respondent, you will need a larger target audience.

Sequential monadic (Multiple concept evaluation)

Respondents fully evaluate multiple concepts. When you’ve collected responses from many respondents, look at the most common reactions to the stimuli to pick the winning concept.

This survey is suitable for a smaller target audience than the monadic design, thus making it more cost-effective. Nonetheless, to keep your survey manageable, you will have to limit the questions about each stimulus, leading to fewer insights.

2. Determining the relevant metrics and scales

Metrics help you decide whether a specific feature meets your customers’ expectations. For example, you may want to know about a particular feature’s appeal, innovativeness, relevance, quality, uniqueness, purchase objective, and/or value.

The relative value of each metric will depend on your objective for the product. So, if you want to win loyal customers, you’ll place more importance on quality.

There are different ways to measure metrics, such as the Likert Scale – a simple and intuitive scale that offers respondents consistent choices while facilitating easy analysis. Also, scales with 5-7 points help illustrate a significant jump in value between the points and represent a wide range of respondent opinions. Further, ensure consistency in the structure and order of the scales to minimize confusing the respondents.

Likewise, ensure consistent labeling, as labeling only some features creates a bias towards them. In addition, by including screener, demographic and category-based questions, you can know more about your users and segment your results group-wise.

3. Nature and flow of questions

Start simple. Begin with an introduction in clear, simple language; ask demographic questions and a few suitability questions to ensure that the questions fit your audience preference. An organized flow of questions eases respondents into the survey and helps them answer more accurately.

As you progress through the main section, you can add core survey questions in this section. The flow of questions in this section should typically:

- Establish the criterion of the respondent’s purchase history

- Introduce, evaluate and explore the concept

- Compare the concept

In short, when framing your question, you must cover the following significant areas in your concept test:

- Measurement of the overall response to the product or service.

- The need for the product or its relative improvement over the current system.

- The overall acceptability, desirability, and interest in the product or service.

- The possibility of purchasing or using the product or service.

Likewise, questions related to likes/dislikes about the concept, awareness of substitutes, current use of competing products, price sensitivity, purchasing methods, etc., should be assessed.

A common question structure, “Other – give details,” is often seen in surveys templates. Previously, market researchers found it challenging to analyze these open text responses. However, advances such as text analytics software automatically score and analyze these questions now, eliminating the hassles of interpreting insights and patterns.

Also, asking respondents to rank questions helps you get a relative score and forces a choice where only one item can be at the top. This produces more reliable data. However, it can be challenging for the respondent.

On the other hand, asking respondents to rate the questions on a scale, though more straightforward, can result in poorer-quality data. For example, when a participant rates all the items the same.

4. Getting off the survey to your respondents

PX Testing can help you determine which product features are viable and which you should not pursue. In addition, you can get feedback in 2 ways from your users.

Focus group

You could collect comprehensive customer feedback on a diverse range of questions using focus groups. However, it may be costly, and you may be unable to collate feedback from a representative sample of your target customers.

Online surveys

These market research panels enable you to access your target audiences and collect feedback in minutes. Though it may be more cost-effective than a focus group, it could be a little less comprehensive.

4. Analytics

When you do PX testing, there’ll be plenty of data generated. If you’re using advanced systems and concept testing tools, you’ll be able to easily pre-assemble data together into reports.

For manual sorting, spreadsheet software like Microsoft Excel can help you sort, filter, compare and chart your results. In addition, you can also try to organize the data into a visual format with charts, 3D mapping, and sparklines.

For a better understanding, you can split your analysis into two sections:

- Overall results foran overview of the highest-performing concepts.

- Individual results for a detailed understanding of each concept, how it performed, and why. Using psychographic segmentation can help you gather more information.

Qualitative analysis for open ended questions can be broken down into common themes, strengths, and weaknesses. Using analytics tools offers faster and speedy analysis.

Conclusion

PX Testing is an excellent way for business leaders to gain actionable insights and make informed decisions while avoiding costly consequences. Likewise, it can help facilitate team support early on, as a ‘first look’ at the test results can show the potential of the task they’ll be helping with.

Moreover, PX Testing is an essential tool for product managers and senior executives looking for flexible solutions instead of launching a flawed product and doubles as a quality-assurance check over time. It also works more economically than hiring external research agencies.

Most importantly, with PX Testing, you can discover valuable customer needs and market data even as you optimize your product, platform or service to meet your customers’ expectations. This helps build brand loyalty, carving an image of a transparent and innovative brand that cares for the opinion of its customers.